FEPI Reaches 100m AUM

REX Shares is excited to announce that FEPI, the REX FANG & Innovation Equity Premium Income ETF, has recently surpassed $100 million in assets under management (AUM)!

Proven Initial Success:

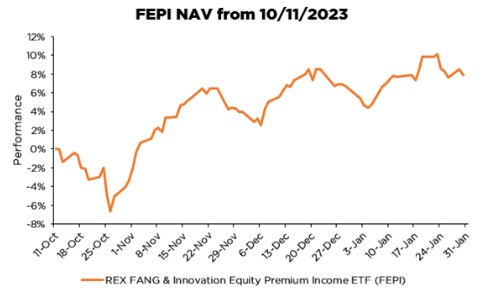

In just three months, FEPI has demonstrated its ability to effectively balance income and growth by producing consistent income without sacrificing NAV appreciation.

Source: Bloomberg LP, as of 2/16/24.

With four distributions under its belt, FEPI has provided investors with a steady annualized distribution yield of 25%.*

Standardized performance can be found here.

Growing Trust and Interest:

FEPI has rapidly gained traction among investors. Achieving this major milestone of $100 Million in AUM in less than five months signals a strong growing interest in our innovative approach.

Interested in Learning More? If you’re curious about FEPI’s approach, we welcome you to book a meeting with a member of our team a deeper understanding of the FEPI strategy.

The Fund’s investment exposure is concentrated in the same industries as that assigned to the underlying securities. Some or all of these risks may adversely affect the Fund’s net asset value (“NAV”) per share, trading price, yield, total return, and/or ability to meet its investment objective. The value of the Fund, which focuses on underlying securities in the technology sector, may be more volatile than a more diversified pooled investment or the market as a whole and may perform differently from the value of a more diversified pooled investment or the market as a whole. Sector Concentration Risk. The trading prices of the Fund’s underlying securities may be highly volatile and could continue to be subject to wide fluctuations in response to various factors. The stock market in general, and the market for technology companies in particular, where applicable, has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of those companies. Liquidity Risk. Some securities held by the Fund, including options contracts, may be difficult to sell or be illiquid, particularly during times of market turmoil. Derivatives Risk. Derivatives are financial instruments that derive value from the underlying reference asset or assets, such as stocks, bonds, or funds (including ETFs), interest rates or indexes. The Fund’s investments in derivatives may pose risks in addition to, and greater than, those associated with directly investing in securities or other ordinary investments, including risk related to the market, imperfect correlation with underlying investments or the Fund’s other portfolio holdings, higher price volatility, lack of availability, counterparty risk, liquidity, valuation and legal restrictions. Call Writing Strategy Risk. The path dependency (i.e., the continued use) of the Fund’s call writing strategy will impact the extent that the Fund participates in the positive price returns of the underlying reference securities and, in turn, the Fund’s returns, both during the term of the sold call options and over longer time period. High Portfolio Turnover Risk. The Fund may actively and frequently trade all or a significant portion of the Fund’s holdings. A high portfolio turnover rate increases transaction costs, which may increase the Fund’s expenses. New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have a track record or history on which to base their investment decisions. Non-Diversification Risk. Because the Fund is non-diversified, it may invest a greater percentage of its assets in the securities of a single issuer or a smaller number of issuers than if it was a diversified fund.

Options Contracts. The use of options contracts involves investment strategies and risks different from those associated with ordinary portfolio securities transactions. The prices of options are volatile and are influenced by, among other things, actual and anticipated changes in the value of the underlying instrument, including the anticipated volatility, which are affected by fiscal and monetary policies and by national and international political, changes in the actual or implied volatility of the underlying reference security, the time remaining until the expiration of the option contract and economic events. For the Fund in particular, the value of the options contracts in which it invests are substantially influenced by the value of the underlying securities.

Money Market Securities Risk. The Fund may invest in money market securities, which are short-term, highly rated fixed income securities. Although money market securities typically carry lower risk than equity securities, return of principal and interest may not be guaranteed.

Index: The Solactive® FANG Innovation Index includes 15 highly liquid stocks focused on technology. These large, tech-enabled equity securities are all listed and domiciled in the U.S. The Index is comprised of eight core-components Apple (AAPL), Amazon (AMZN), Meta Platforms (META), Alphabet (GOOGL), Microsoft (MSFT), Netflix (NFLX), NVIDIA (NVDA), Tesla (TSLA) AND the seven top traded names across the technology sector. Out of the Money Option: An out of the money call option has a strike price that is higher than the price of the underlying asset.

Call Option: Call options are financial contracts that give the buyer the right—but not the obligation—to buy a stock, bond, commodity, or other asset or instrument at a specified price within a specific period.

Funds distributed by: Foreside Fund Services, LLC, not affiliated with Rex Shares, LLC, or its affiliates.