AIPI Reaches $50M Milestone

REX Shares is excited to announce that AIPI, the REX AI Equity Premium Income ETF, has recently surpassed $50 million in assets under management (AUM)!

Initial Performance:

In just under four months, AIPI has demonstrated its ability to effectively balance income and growth by producing consistent income without sacrificing NAV appreciation.

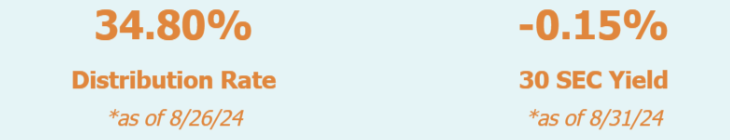

*The Distribution Rate is the annual yield an investor would receive if the most recently declared distribution, which includes option income, remained the same going forward. The Distribution Rate is calculated by multiplying an ETF’s Distribution per Share by twelve (12), and dividing the resulting amount by the ETF’s most recent NAV. The Distribution Rate represents a single distribution from the ETF and does not represent its total return. Current distributions may include return of capital (ROC). For full details on the composition of distributions, please refer to the latest 19a-1 notice.

**The 30-Day SEC Yield represents net investment income, which excludes option income, earned by such ETF over the 30-Day period, expressed as an annual percentage rate based on such ETF’s share price at the end of the 30-Day period. The REX AI Equity Premium Income ETF has a gross expense ratio of 0.65%. Distributions are not guaranteed.

The Distribution Rate and 30-Day SEC Yield is not indicative of future distributions, if any, on the ETFs. In particular, future distributions on any ETF may differ significantly from its Distribution Rate or 30-Day SEC Yield. You are not guaranteed a distribution under the ETFs. Distributions for the ETFs (if any) are variable and may vary significantly from month to month and may be zero. Accordingly, the Distribution Rate and 30-Day SEC Yield will change over time, and such change may be significant. The distribution may include a combination of ordinary dividends, capital gain, and return of investor capital, which may decrease a fund's NAV and trading price over time. As a result, an investor may suffer significant losses to their investment. These distribution rates caused by unusually favorable market conditions may not be sustainable. Such conditions may not continue to exist and there should be no expectation that this performance may be repeated in the future. Additional fund risks can be found below.

Interested in Learning More? If you’re curious about AIPI's approach, book a meeting with our team for a deeper understanding of the AIPI strategy.

Standardized performance can be found here.

-

The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance, please call 1-844-802-4004 or visit the Fund's website at AIPI - REX Shares.

The Fund’s investment exposure is concentrated in the same industries as that assigned to the underlying securities. Some or all of these risks may adversely affect the Fund’s net asset value (“NAV”) per share, trading price, yield, total return, and/or ability to meet its investment objective. The value of the Fund, which focuses on underlying securities in the technology sector, may be more volatile than a more diversified pooled investment or the market as a whole and may perform differently from the value of a more diversified pooled investment or the market as a whole.

-

Investing in the Funds involves a high degree of risk. As with any investment, there is a risk that you could lose all or a portion of your investment in the Funds.

THE FUND, TRUST, ADVISER, AND SUB-ADVISER ARE NOT AFFILIATED WITH THE FUND’S UNDERLYING SECURITIES.

Sector Concentration Risk. The trading prices of the Fund’s underlying securities may be highly volatile and could continue to be subject to wide fluctuations in response to various factors. The stock market in general, and the market for technology companies in particular, where applicable, has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of those companies.

Liquidity Risk. Some securities held by the Fund, including options contracts, may be difficult to sell or be illiquid, particularly during times of market turmoil.

Derivatives Risk. Derivatives are financial instruments that derive value from the underlying reference asset or assets, such as stocks, bonds, or funds (including ETFs), interest rates or indexes. The Fund’s investments in derivatives may pose risks in addition to, and greater than, those associated with directly investing in securities or other ordinary investments, including risk related to the market, imperfect correlation with underlying investments or the Fund’s other portfolio holdings, higher price volatility, lack of availability, counterparty risk, liquidity, valuation and legal restrictions.

Distribution Risk. As part of the Fund’s investment objective, the Fund seeks to provide current monthly income. There is no assurance that the Fund will make a distribution in any given month. If the Fund does make distributions, the amounts of such distributions will likely vary greatly from one distribution to the next. Additionally, the monthly distributions, if any, may consist of returns of capital, which would decrease the Fund’s NAV and trading price over time. As a result, an investor may suffer significant losses to their investment.

NAV Erosion Risk. Due to Distributions. When the Fund makes a distribution, the Fund’s NAV will typically drop by the amount of the distribution on the related ex-dividend date. The repeated payment of distributions by the Fund, if any, may significantly erode the Fund’s NAV and trading price over time. As a result, an investor may suffer significant losses to their investment.

Call Writing Strategy Risk. The path dependency (i.e., the continued use) of the Fund’s call writing strategy will impact the extent that the Fund participates in the positive price returns of the underlying reference securities and, in turn, the Fund’s returns, both during the term of the sold call options and over longer time period.

High Portfolio Turnover Risk. The Fund may actively and frequently trade all or a significant portion of the Fund's holdings. A high portfolio turnover rate increases transaction costs, which may increase the Fund's expenses.

New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have a track record or history on which to base their investment decisions.

FLEX Options Risk. The Fund may invest in FLEX Options issued and guaranteed for settlement by The Options Clearing Corporation (“OCC”). The Fund bears the risk that the OCC will be unable or unwilling to perform its obligations under the FLEX Options contracts.

Non-Diversification Risk. Because the Fund is non-diversified, it may invest a greater percentage of its assets in the securities of a single issuer or a smaller number of issuers than if it was a diversified fund.

Options Contracts. The use of options contracts involves investment strategies and risks different from those associated with ordinary portfolio securities transactions. The prices of options are volatile and are influenced by, among other things, actual and anticipated changes in the value of the underlying instrument, including the anticipated volatility, which are affected by fiscal and monetary policies and by national and international political, changes in the actual or implied volatility of the underlying reference security, the time remaining until the expiration of the option contract and economic events. For the Fund in particular, the value of the options contracts in which it invests are substantially influenced by the value of the underlying securities.

Money Market Securities Risk. The Fund may invest in money market securities, which are short-term, highly rated fixed income securities. Although money market securities typically carry lower risk than equity securities, return of principal and interest may not be guaranteed.

Associated Risks Related to Investing in Artificial Intelligence. Artificial Intelligence typically faces intense competition and potentially rapid product obsolescence. These companies are also heavily dependent on intellectual property rights and may be adversely affected by loss or impairment of those rights. There can be no assurance these companies will be able to successfully protect their intellectual property to prevent the misappropriation of their technology, or that competitors will not develop technology that is substantially similar or superior to such companies’ technology. Artificial Intelligence typically engages in significant amounts of spending on research and development and mergers and acquisitions, and there is no guarantee that the products or services produced by these companies will be successful. Artificial Intelligence is a potential target for cyberattacks, which can have a materially adverse impact on the performance of these companies. In addition, artificial intelligence technology could face increasing regulatory scrutiny in the future, which may limit the development of this technology and impede the growth of companies that develop and/or utilize this technology. Similarly, the collection of data from consumers and other sources could face increased scrutiny as regulators consider how the data is collected, stored, safeguarded and used. Artificial Intelligence may face regulatory fines and penalties, including potential forced break-ups, that could hinder the ability of the companies to operate on an ongoing basis. The customers and/ or suppliers of Artificial Intelligence may be concentrated in a particular country, region or industry. Any adverse event affecting one of these countries, regions or industries could have a negative impact on Artificial Intelligence. Country, government, and/or region-specific regulations or restrictions could have an impact on Artificial Intelligence.

Technology Industry Risk. The stock prices of technology and technology-related companies and, therefore, the value of the Fund, may experience significant price movements as a result of intense market volatility, worldwide competition, consumer preferences, product compatibility, product obsolescence, government regulation, excessive investor optimism or pessimism, or other factors.

Index: The BITA AI Leaders Select Index is a rules-based composite index that tracks the market performance of companies, listed on recognized exchanges based in the US, that are at the forefront of AI technologies. The final BITA AI Leaders Select Index is calculated by aggregating the “Purity Leaders” and “Key Enablers” categories and weighting them in a fixed proportion of 40% and 60%respectively. The index is rebalanced monthly and reconstituted quarterly.

Funds distributed by: Foreside Fund Services, LLC, not affiliated with Rex Shares, LLC, or its affiliates.