Case Study: Strategy’s 2030 Convertible Bond

Strategy has transformed from a business intelligence company into the largest publicly traded corporate holder of Bitcoin—not through mining or operational cash flow, but by repeatedly tapping the capital markets. Over the past few years, the company has issued multiple rounds of convertible debt to raise billions of dollars, all with one primary goal: to acquire more Bitcoin. These notes, typically low or even zero-coupon, offer bondholders the potential to convert into equity if Strategy’s Bitcoin-heavy stock price rises, while allowing the company to access cheap capital without immediate dilution or cash repayment.

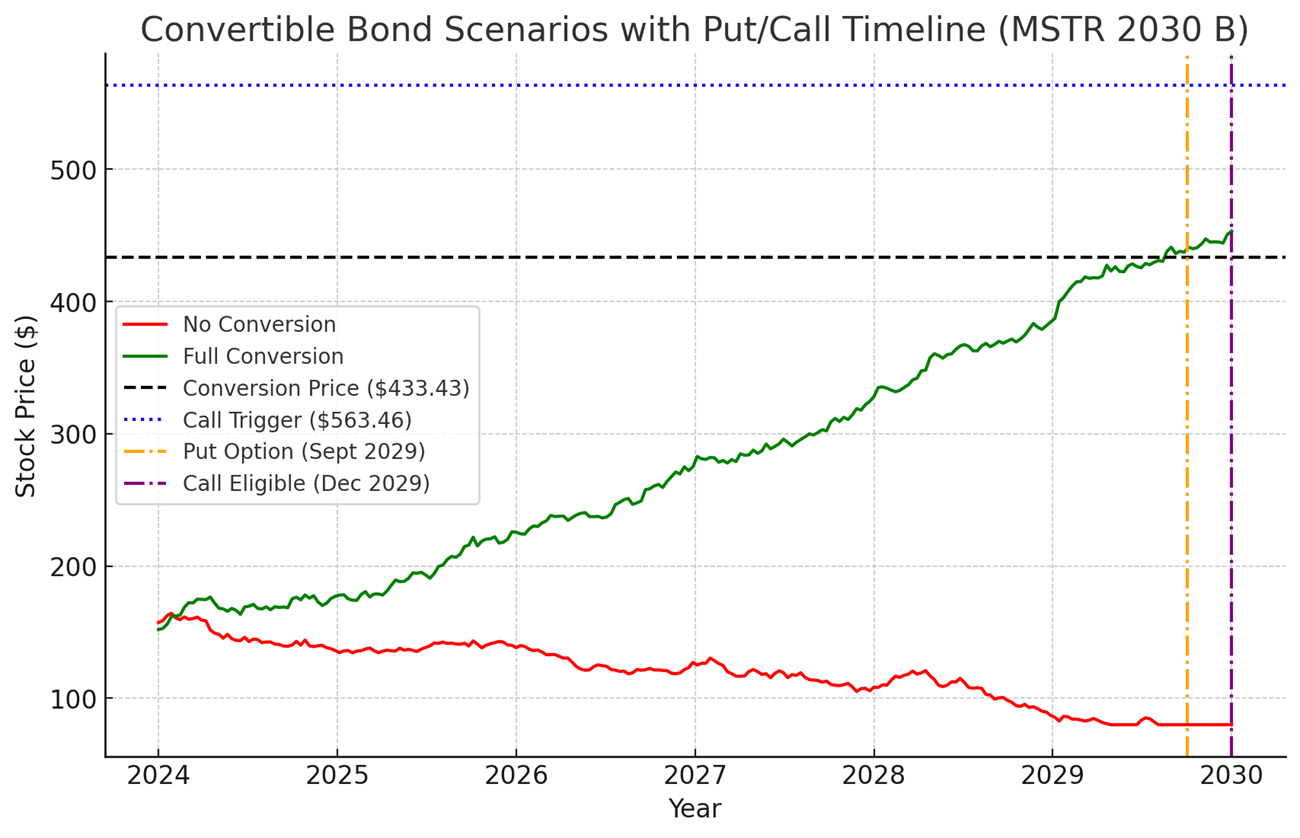

This case study unpacks the strategy in full, with a focus on the $2 billion 0% convertible bond maturing in 2030. We’ll break down the mechanics, triggers, risks, and upside—along with visual timelines and scenario modeling—to explain how this unique structure aligns with Strategy’s bold bet on Bitcoin.

Key Terms of the Strategy 2030 Convertible Bond

| Term | Details |

| Issue Date | February 21, 2025 (Rule 144A private placement) |

| Principal | $2 billion total face value |

| Coupon Rate | 0% |

| Maturity Date | March 1, 2030 |

| Conversion Price | $433.43 per share → 2.3072 shares per $1,000 bond |

| Reference Price | $321.05 (at issuance) |

| Conversion Premium | ~35% above reference price |

| Bitcoin Par Level | ~$96,200 per BTC (implied stock level at time of issuance) |

| Holder Put Option | March 1, 2028 → Bondholders can request early repayment at par |

| Company Call Option | From March 5, 2027 if MSTR trades > $996.89 (130% of conversion price) |

| Settlement Option | Strategy may deliver cash, stock, or a combination |

| Seniority | Unsecured senior debt |

With these terms in mind, the bond essentially gave Strategy $2 billion of capital at 0% interest, with the trade-off that if the stock performs extremely well, investors can convert that debt into equity (diluting shareholders). At issuance, the stock price ($321.05) and Bitcoin price (~$96k) meant the conversion option was out-of-the-money. However, the long maturity and Strategy’s Bitcoin-centric strategy implied that down the road the stock could rise enough to make conversion attractive.

How the Convertible Bond Works

Strategy’s 2030 convertible bond pays no interest and gives bondholders the option to convert into stock — only if it’s worth more than $1,000.

- Conversion: Each bond can turn into 3072 shares if MSTR stock goes above $433.43.

- Put Option: Investors can choose to get $1,000 back a year early if the stock stays below the conversion price.

- Call Option: If the stock goes above $996.89 after Mar 2027, Strategy can force redemption — bondholders can convert or take cash.

- Payout Method: The company can pay in stock, cash, or a mix — usually cash for the $1,000, and stock for any extra value.

Through this structure, Strategy gave investors a clear bargain as long as MSTR can pay back the bonds: if the company’s stock (and by extension Bitcoin) soars, investors share in the upside by converting to equity; if it doesn’t, investors can fall back on the bond’s principal. Now let’s examine scenarios of what might happen by 2027–2028, and what each outcome means for both the bondholders and Strategy.

Potential Outcomes: Will the Bond Convert or Not?

By 2028, one of two outcomes will likely occur:

- No conversion: Bondholders redeem for $1,000; Strategy pays in cash.

- Conversion: Bondholders convert into equity; Strategy avoids a large cash outlay but dilutes shareholders.

Call Option Activation:

- After March 5, 2027, if stock >130% of conversion price (~996.89 +), Strategy can call the bond.

- Bondholders will likely convert to avoid being cashed out at $1,000.

Key Implications:

- Bondholders capture upside, essentially swapping debt for equity at a favorable price.

- Strategy gets to “pay” with equity instead of cash.

- Dilution is a trade-off for having raised capital cheaply and successfully.

Put and call features simply adjust the timing of these outcomes. For bondholders, it’s a strategic blend of downside protection with potential upside participation in Strategy’s Bitcoin-driven growth.

Scenario 1: Bond Does Not Convert (MSTR Stock Remains Below $433.43)

Overview:

If Strategy’s stock remains below the $433.43 conversion price—due to stagnant or declining Bitcoin prices—bondholders are unlikely to convert and will opt to redeem for cash instead.

In the no-conversion scenario, bondholders take the safe route. With Strategy’s stock staying below the $433.43 conversion price, there’s little incentive to swap debt for equity. Instead, many investors are expected to exercise the put option in Mar 2028, cashing out early and reclaiming their $1,000 principal a year before maturity.

On Strategy’s side, this outcome means writing a $2 billion check — likely in 2028 — to repay bondholders who put the notes. The company might pull from reserves, sell some Bitcoin, or refinance to cover the payout. The upside? No dilution. Shareholders keep their stake intact. The trade-off? It’s a hit to liquidity.

Ultimately, this path represents a low-risk, low-reward outcome. Bondholders get their money back and shareholders avoid dilution.

Scenario 2: Bond Converts (MSTR Stock Rises Above $433.43)

Overview:

If MSTR stock rises well above the conversion price—thanks to a Bitcoin rally—conversion becomes highly attractive.

In the conversion scenario, things play out favorably for both bondholders and the company.

As Strategy’s stock climbs well above the $433.43 conversion price — likely driven by a strong Bitcoin rally — bondholders are in a great position. Each $1,000 bond converts into approximately 2.31 shares of MSTR. At $500 per share, that’s about $1,155 in value; at $700, it’s over $1,600.

For Strategy, conversion brings real benefits. The company doesn’t need to repay the $2 billion in cash. Instead, it would issue new shares. While this results in dilution, it comes alongside a much stronger stock price and a healthier balance sheet. The debt is effectively wiped out and replaced by equity, improving the company’s financial health.

In this outcome, bondholders capture meaningful upside, shareholders see the value of their investment grow, and Strategy strengthens its capital structure — trading future equity for present momentum.

Scenario 3: Bitcoin Price Declines Significantly

If Bitcoin’s price experiences a sustained decline well below current levels—say into the $30,000 range or lower—Strategy’s stock would likely remain under the $433.43 conversion threshold. In this case, bondholders would be expected to exercise the put option in 2028 and redeem their notes for $1,000 in cash.

For Strategy, this would mean needing to repay up to $2 billion in principal without the benefit of equity conversion. The company could seek to fund this repayment by drawing on reserves, selling a portion of its Bitcoin holdings, or refinancing the debt. However, a weaker BTC environment might make capital markets access more challenging, and selling Bitcoin at lower prices could be less efficient.

While this scenario avoids shareholder dilution, it places a greater cash burden on the company. It underscores the trade-off in Strategy’s approach: gaining exposure to Bitcoin’s upside through debt-financed purchases, while accepting potential liquidity pressure if BTC underperforms.

Conclusion

Strategy’s 2030 convertible bond represents a bold fusion of capital markets engineering and a high-conviction macro thesis. By issuing zero-coupon debt with equity optionality, the company has secured billions in low-cost capital while offering bondholders asymmetric upside tied to Bitcoin’s performance. The structure provides strategic flexibility—whether MSTR stock soars, stagnates, or falls—through a mix of conversion, put, and call mechanics. Yet this same flexibility comes with trade-offs: dilution risk in upside scenarios, cash strain in downside ones, and heightened exposure to BTC volatility across all outcomes. Ultimately, this case study reflects a company using financial tools not just to fund growth, but to make a directional bet on the future of digital assets—with all the risks and rewards that entails.