Decoding Strategy’s KPIs: A New Financial Playbook for the Digital Age

As MicroStrategy evolves into Strategy—a technology operating company powered by a Bitcoin-native balance sheet—it’s pioneering a new form of financial reporting. Hosted on Strategy.com, its suite of Bitcoin-centric Key Performance Indicators (KPIs) reimagines how corporate performance can be tracked in the digital asset era.

These aren't just creative metrics. They represent a radical shift in how companies can use real-time, blockchain-based reporting to drive transparency, investor alignment, and long-term strategy.

Rethinking Financial Performance with Bitcoin KPIs

At the heart of Strategy’s reporting framework is a single goal: maximize long-term Bitcoin ownership. To track this, Strategy has built a transparent, data-driven system that gives investors a clear view into how capital—whether from operations, debt, or equity—is being converted into Bitcoin. Let’s break down the KPIs that make this possible.

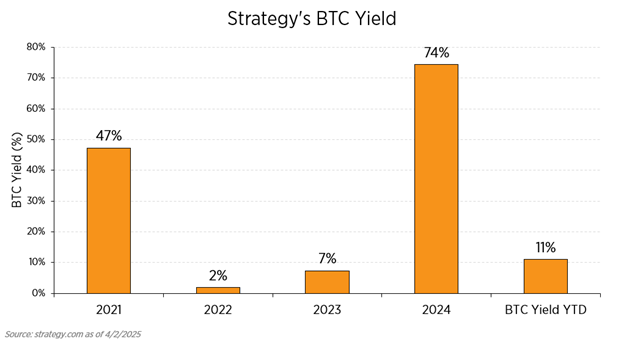

- BTC Yield

Definition: The percentage increase in Strategy’s Bitcoin holdings over a given period.

Why it matters:

BTC Yield functions like a crypto-native version of Return on Invested Capital (ROIC). It reflects the company’s ability to deploy capital efficiently and convert it into Bitcoin over time.

To draw a comparison to another bitcoin investment option, think about purchasing a spot BTC ETF. Each share will correspond to certain number of BTC an investor is exposed to. BTC per share will slowly decrease over time as the fund manager sells BTC to cover expenses. MSTR, on the other hand, actually increases BTC per share with additional purchases of BTC through unique financing options (ie. convertible debt). Note, however, unlike with a spot BTC ETF, an investor may be buying MSTR shares at a value higher than that of MSTR’s BTC holdings. yield allows investors to monitor how much more BTC they are exposed to YoY.

Example: In Q4 2024, Strategy posted a 5.1% BTC Yield, adding over 45,000 BTC in a single quarter.

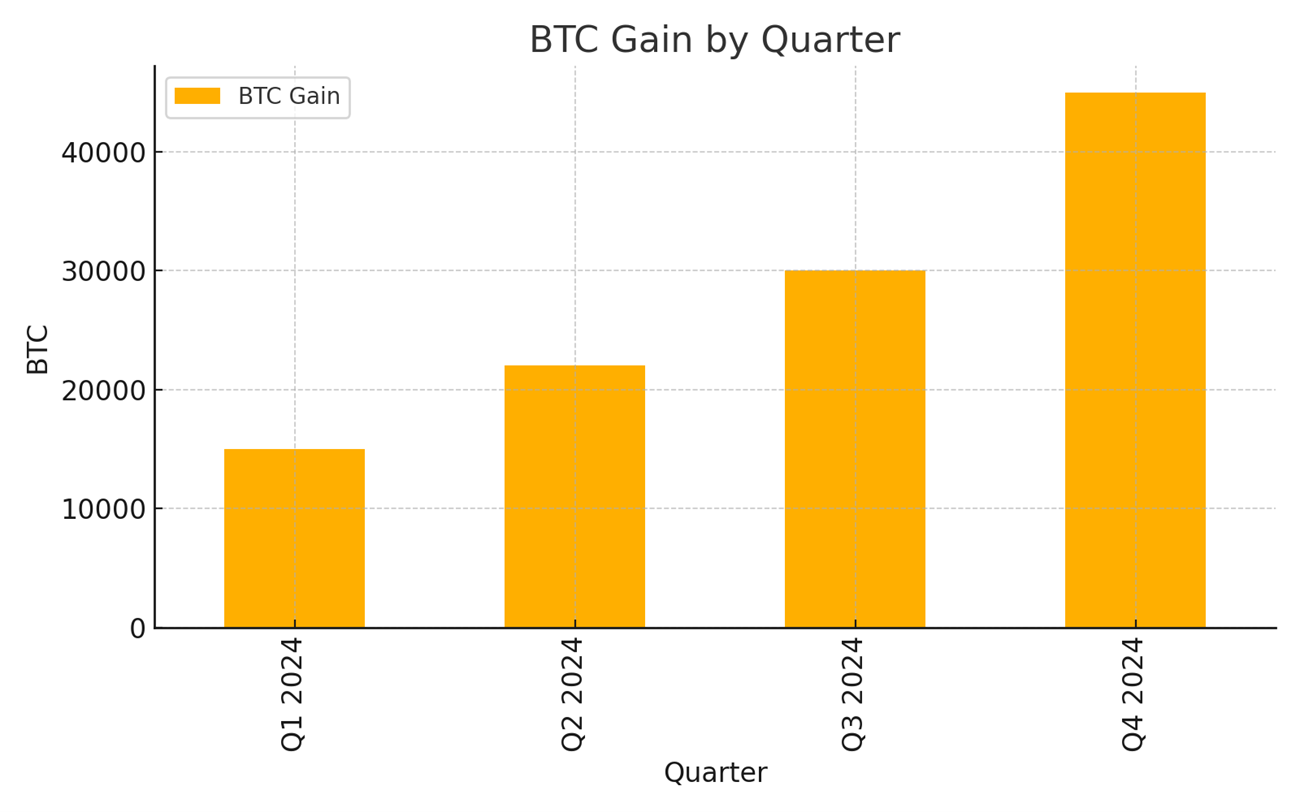

- BTC Gain and BTC $ Gain

Definition:

- BTC Gain = Bitcoins added to holdings.

- BTC $ Gain = Dollar value of the BTC acquired at time of acquisition.

Why it matters:

These metrics quantify the company’s growth in Bitcoin, both in absolute terms and by capital efficiency. It gives investors a transparent look at how much Bitcoin is being added relative to resources deployed.

Example: By December 2024, Strategy held over 447,000 BTC, with ~200,000 BTC acquired in just six months—much of it funded through zero-coupon convertible debt and at-the-market equity issuance.

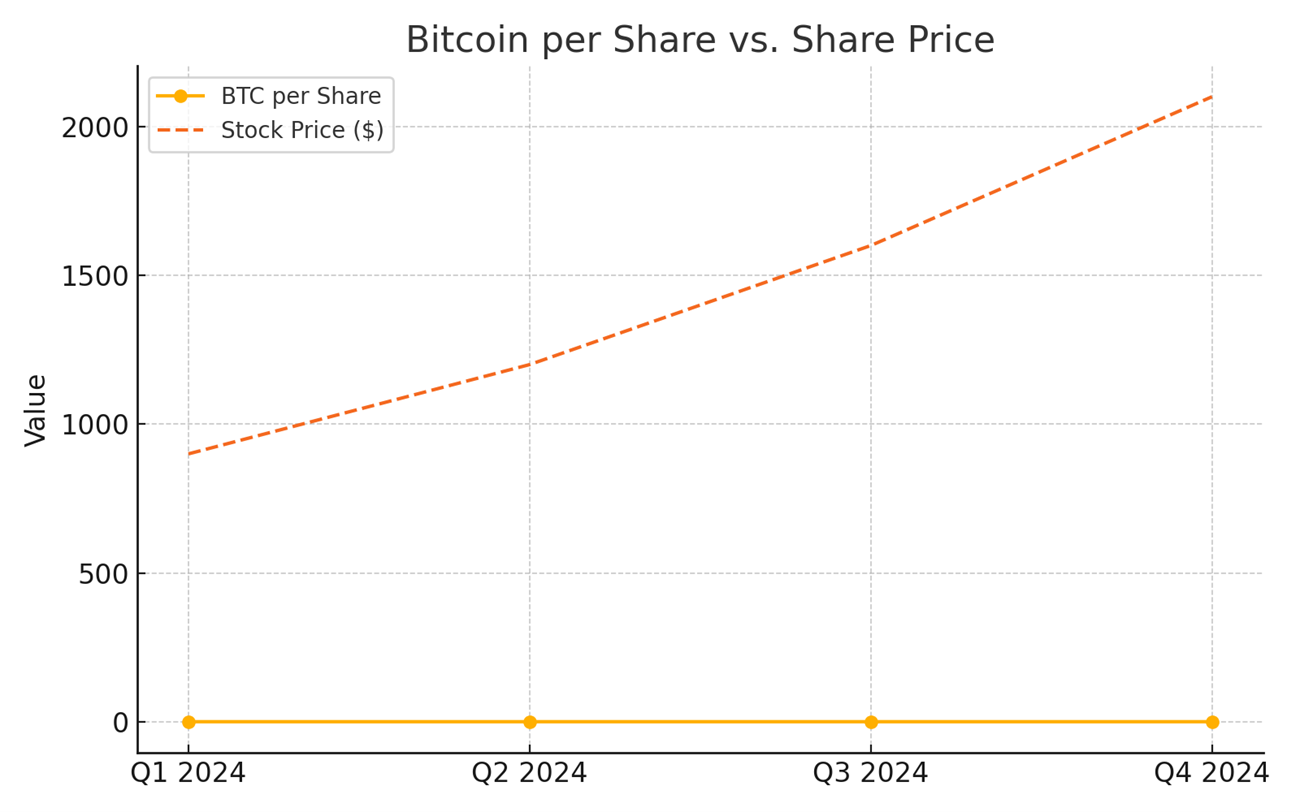

- Bitcoin per Share

Definition:

Total BTC holdings divided by outstanding shares. This serves as a crypto-native version of Net Asset Value (NAV) per share.

Why it matters:

This metric helps equity investors understand how much Bitcoin is backing each share. It’s a direct line to intrinsic value based on the company’s core asset strategy.

Example: With 450,000 BTC and 15 million shares outstanding, each share represents approximately 0.03 BTC, or $2,100 per share (at $70,000 BTC).

- Total Bitcoin Holdings

Definition:

The total amount of Bitcoin held on the company’s balance sheet.

Why it matters:

This is the most straightforward indicator of progress—and the ultimate north star of Strategy’s financial model.

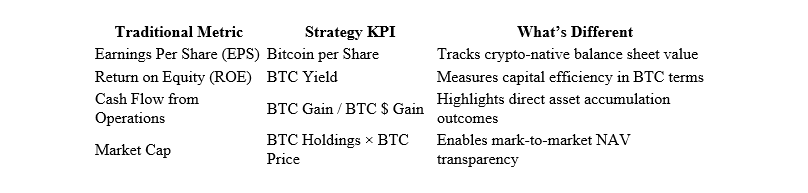

Redefining Corporate KPIs in a Digital World

Why This Matters: Finance Is Being Rewritten

Strategy.com’s KPI dashboard isn’t just novel—it’s foundational. It could serve as the blueprint for how future companies operating in the digital asset economy report performance.

- On-Chain Accountability

Bitcoin is verifiable, timestamped, and scarce. Strategy’s KPIs echo this ethos—offering trustless, real-time transparency. - Next-Gen Financial Modeling

Investors can model company value based not only on earnings, but on Bitcoin acquisition efficiency—a critical edge as crypto becomes core treasury infrastructure. - Investor Empowerment

Strategy brings more transparency to the public markets—allowing everyday investors to monitor real asset accumulation, not just narratives.

Final Thoughts: A Financial Operating System for the Bitcoin Era

As traditional metrics strain to capture the dynamics of decentralized, programmable assets, Strategy has introduced a radically transparent model for corporate finance.

Its KPIs do more than inform—they align investor understanding with real-time execution.

For forward-thinking investors, Strategy.com offers more than a dashboard.

It’s a window into how the next generation of public companies might build, measure, and communicate value.