ETFs Under The Hood

ETFs: A Quick Recap

Think of an exchange traded fund (ETF) as a wrapper or a box. It’s simply the packaging that holds a group of securities based on its investment objective. One ETF may track a specific index, like the Nasdaq-100®, another may be actively managed and purchase stocks of only biotech companies or only healthcare companies, while another may focus on bonds from various municipalities. Regardless of the investment objective, the important thing to remember is that each ETF is made up of different individual pieces. As we’ll discuss later, the ability to assemble, break down, and reassemble those individual pieces, called the creation and redemption processes, is what drives both the liquidity and the potential tax benefits of ETFs.

ETFs offer investors important advantages compared to mutual funds. First, an investor who’s looking to buy or sell a particular ETF doesn’t have to wait until the end of the trading day to complete a transaction. ETFs can be bought and sold whenever the market is open. In addition, ETFs also sport higher levels of daily transparency than mutual funds, as most ETFs publish their underlying holdings daily.

ETFs Under the Hood: The Primary and Secondary Market Players

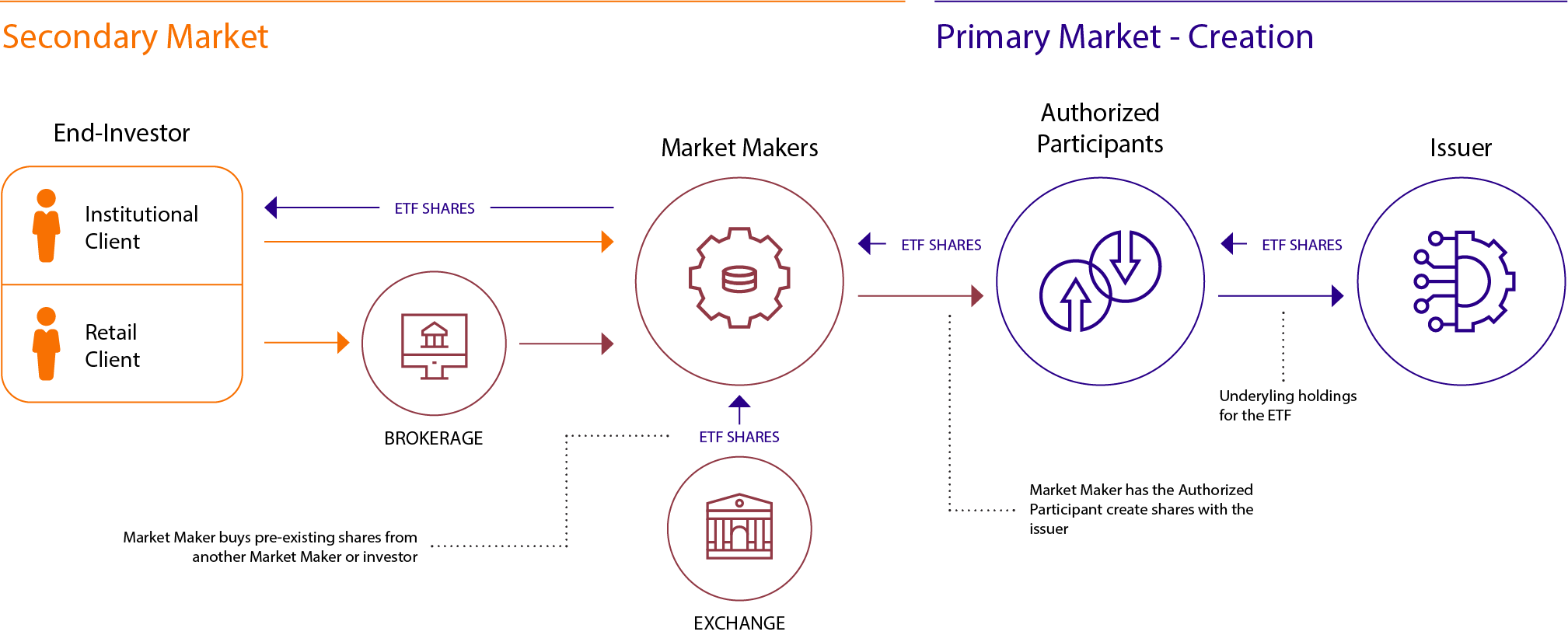

After a buyer (retail or institutional) places an order for an ETF, there are multiple ways traders can source the shares for that end-investor’s account. ETF traders can operate in two markets: on the secondary market, which involves buying and selling shares that currently exist on an exchange, or on the primary market, where ETF share creation and redemption orders take place. The creation order process results in new shares of the ETF being made from an ETF’s individual holdings and added to the previously existing ETF shares outstanding on the exchange. Conversely, the redemption order process breaks down existing ETF shares into their individual components and removes them from the pool of ETF shares trading on the exchange. Here’s a rundown of the ETF transaction lifecycle for a buy order and the key players involved in the ETF primary and secondary markets:

• Investors: From individuals to institutions, investors are the end-buyers or end-sellers of ETFs.

• ETF Issuers: Issuers are the companies that sponsor ETFs, list them on an exchange (such as Nasdaq) and manage the fund. When a new ETF comes to market, it’s funded with seed capital — typically from a bank, a major investor, or the ETF issuer itself. The seed capital is used to buy the securities that will form the initial shares of the ETF listed on the exchange.

• Exchange: Exchanges, like Nasdaq, are regulated platforms where companies/issuers can list their shares, and traders meet to buy and sell. Exchanges host the secondary market.

• Authorized Participants: Authorized Participants (APs) are allowed to place creation and redemption orders directly with ETF issuers. This allows APs to give issuers underlying holdings to receive created ETFs shares, or to redeem existing ETF shares with issuers to receive the underlying holdings. APs are typically banks but can be any self-clearing broker-dealer either acting as an agent, processing creations and redemptions on behalf of investors or market makers, or acting as a principal, creating and redeeming when it’s profitable for managing their own exposure. Market Makers can also be APs acting in a principal capacity.

• Market Makers: ETF Market Makers (MMs) are trading firms that specialize in facilitating the buying and selling of ETF shares on the exchange, offering ongoing daily access to ETF shares for investors. Market Makers buy when investors want to sell and sell when investors wish to buy — and profit on the difference in price between those transactions. They may also have APs submit creation and redemption orders on their behalf.

How is This Different Than Mutual Funds?

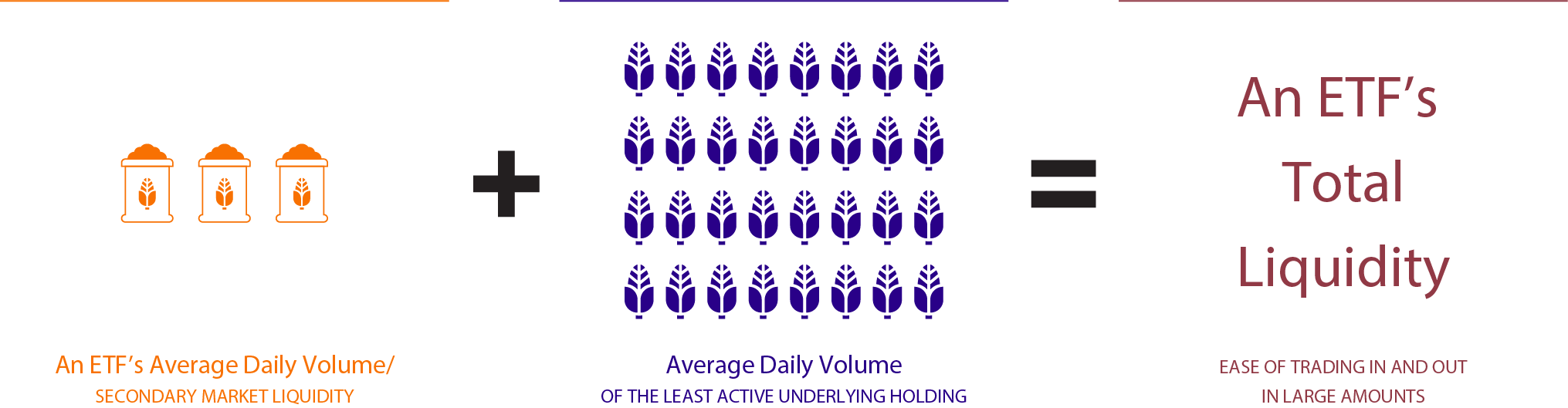

ETFs and mutual funds similarly can create and redeem shares directly with the issuer, but ETFs unlock an additional type of ability to trade shares by being listed on the exchange. The amount of ETF shares being bought or sold on the exchange is an ETF’s secondary market trading volume, or average daily volume (ADV). A security’s average exchange volume is a good barometer for the amount that can be bought and sold on the exchange without significantly moving the price of the security. The primary and secondary markets comprise ETFs’ layers of

liquidity (availability to buy and sell): the first liquidity layer emerging from preexisting ETF shares’ trading volume, and the second layer arising from the ability to create or redeem ETF shares. While every mutual fund transaction results in the purchase or sale of the underlying holdings of the fund, only creations and redemptions result in a change to shares outstanding, and therefore assets under management (AUM) for an ETF. Due to many ETF transactions taking place in the secondary market, ETFs buy or sell their underlying holdings less frequently than a mutual fund, impacting the underlying securities less often.

A Primary Market Creation Example

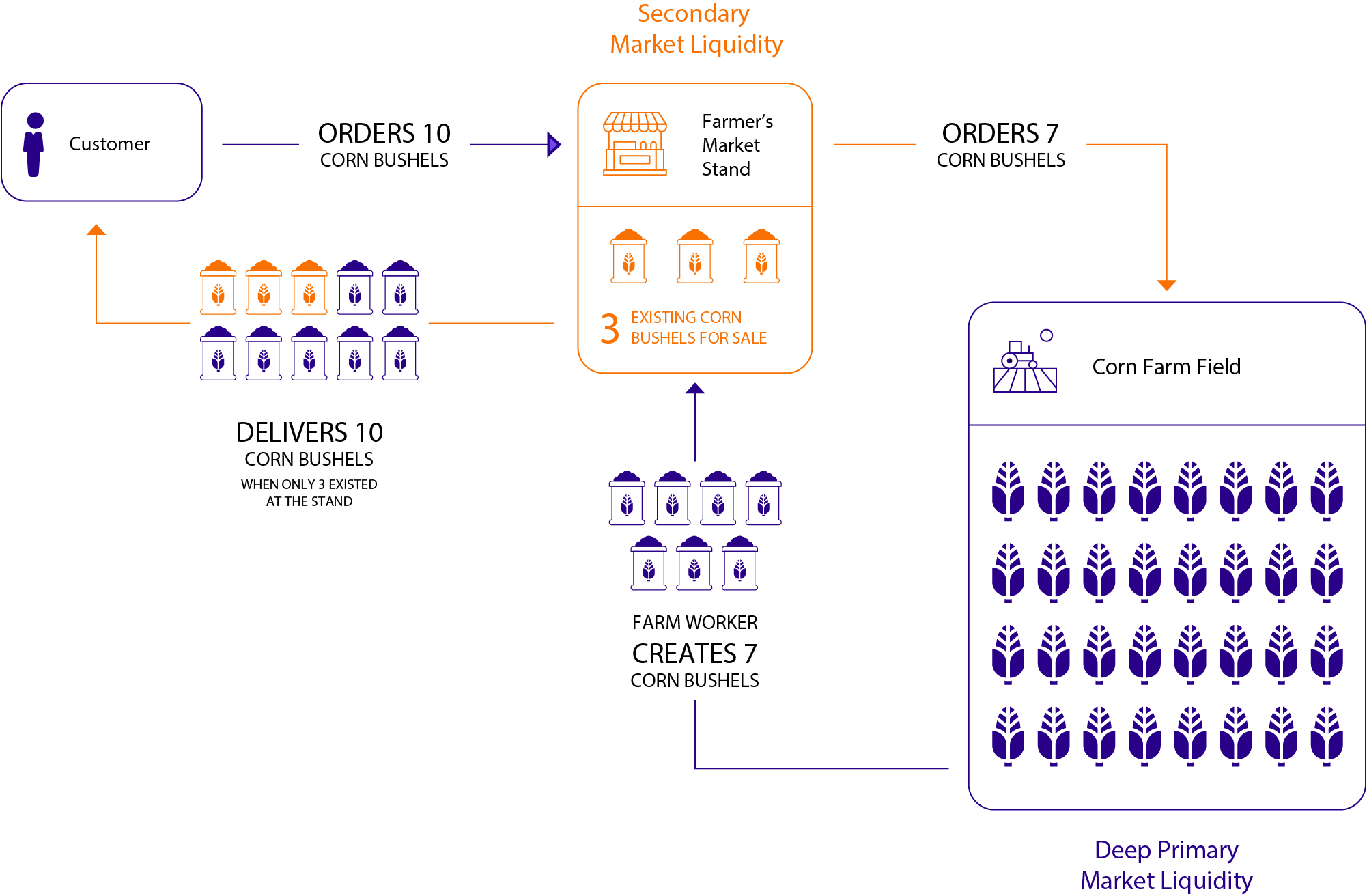

As we now know, when an investor purchases ETF shares, the delivered shares can be sourced from preexisting ETF volume via the secondary market or new shares of the ETF created from underlying holdings via the primary market. From a buyer’s perspective, this is akin to a customer at a farmer’s market stand looking to purchase corn bushels. The salesperson working the stand can source the corn bushels from the existing supply for sale at the stand, representing the secondary market, or new bushels that could be made from the farm’s cornfield, representing the primary market. If the cornfield is plentiful, or the holdings making up the ETF shares have high trading volumes, it is very easy to create these new bushels of corn, or new ETF shares.

What happens when there is a large order, but low volume?

If an investor wants to purchase a much larger amount of an ETF than it trades on an average day, the Market Maker can simply use an AP to create these ETF shares in the primary market on their behalf. This is similar to a customer wanting to buy more bushels of corn than currently exist at the farmer’s market stand, and the stand salesperson asking the farm worker to get as many bushels as the customer needs. Hence, the farm stand’s existing bushels of corn, or the ETF’s ADV, is only a small portion of the total amount available for purchase. An ETF’s total liquidity is comprised of the ETF’s ADV plus the trading volume of the ETF’s least-traded underlying holding.

What about ETFs with high volume?

ETFs with greater volume, indicating more buyers and sellers willing to transact, usually have narrower spreads than those with lower volume. The difference between the Bid and Ask is the cost to buy and sell the ETF and is known as the Spread. The Bid is the highest price at which another market participant is willing to buy shares at, while the Ask is the lowest price a prospective seller is willing to transact. A narrow-spread means that enough buyers and sellers are ETFs with greater volume, indicating more buyers and sellers willing to transact, usually have narrower spreads than those with lower volume. The difference between the Bid and Ask is the cost to buy and sell the ETF and is known as the Spread. The Bid is the highest price at which another market participant is willing to buy shares at, while the Ask in close alignment on the value of the ETF and can transact efficiently. Another key determinant of ETF spreads is the liquidity of the underlying securities themselves: ETFs which own highly liquid stocks or bonds will tend to have narrower spreads than ETFs that own less liquid securities.

Two-Part Tradability Benefits

APs play a vital role in maintaining ETF pricing efficiency.

If the ETF’s price is higher than the fair value of its underlying holdings (its Net Asset Value), the Authorized Participant will buy the underlying holdings of the ETF, pass these holdings to the issuer to create ETF shares (in the primary market), and sell the ETF shares trading at a premium on the exchange (i.e. the secondary market), profiting on the difference. This process brings the ETF’s price down and back in line with the value of its holdings. Contrastingly, if the ETF’s price is lower than the fair value of its underlying holdings, the AP would buy the cheap ETF shares on the secondary market and redeem the shares in the primary market, profiting on the sale of the underlying holdings. This would eventually bring the ETF’s price up, eliminating much or all of its discount to Net Asset Value.

It is important to note that the AP and ETF issuer aren’t selling shares back and forth — they’re passing them in and out of the fund “in-kind” through the creation and redemption processes. The difference may seem trivial, but this ability to create and redeem ETF shares in-kind is what makes Exchange Traded Funds much more efficient from a tax perspective than mutual funds.

When a stock (or bond) is purchased, that purchase price is captured for tax purposes as “cost basis.” Any increase or decrease in value is measured against that basis in terms of taxable gains or losses. If I purchased a share of Kraft Heinz stock (Nasdaq: KHC) for $32 per share, that becomes my cost basis. If I sold it for $40 per share, the $8 gain is (potentially) taxable. Each transaction involving a realized gain or loss is known as a taxable event.

For mutual funds, every time a shareholder adds new money to the fund, the underlying securities must be purchased. Likewise, when a shareholder redeems his or her shares, the underlying securities are sold to generate the cash needed to pay out the proceeds to the shareholder. Taxable events thus accumulate throughout the year. At year-end, the fund’s investors may receive a taxable distribution or “Capital Gains Distribution,” representing the gains generated by the fund’s transactions passed along to the investor.

ETFs, on the other hand, through the creation and redemption process, allow the Issuer and the AP to minimize taxable events by exchanging ETF shares and underlying securities “in-kind” when possible, making capital gains distributions less likely. In this way, an ETF investor’s capital gains are not influenced by other investors entering and exiting the fund. Always consult a tax professional for specific advice or recommendations.

Arbitrage

The process of buying in one market and selling in another to profit from price discrepancies. Arbitrage by Market Makers and Authorized Participants helps to keep the price of an ETF close to its Net Asset Value (NAV).

Conclusion

It’s important for investors to understand how the primary and secondary markets power many of the unique benefits of ETFs. The ETF ecosystem is vast, with multiple participants tasked with providing access, liquidity, and fair pricing. Add tax efficiency into the mix, and it’s easy to see why ETFs have become the vehicle of choice for so many investors.

This resource is brought to you by NASDAQ

Distributed by NASDAQ CAPTIAL MARKETS ADVISORY, LLC, a Registered Broker Dealer and affiliate of Nasdaq, Inc.

Investment Risks

Exchange Traded Products (ETPs) are types of securities that derive their value from a basket of underlying securities such as stocks, bonds, commodities, etc., and trade intra-day on a national securities exchange. Generally, ETPs take the form of Exchange Traded Funds (ETFs) or Exchange Traded Notes (ETNs). Each ETP has a unique risk profile, detailed in its prospectus, offering circular, or similar material, which should be considered carefully when making investment decisions.

Exchange Traded Funds (ETFs) are subject to market risk, including the possible loss of principal. The value of the portfolio will fluctuate with the value of the underlying securities. ETFs may trade at a premium or discount to their net asset value. ETFs may have underlying investment strategy risks similar to investing in commodities, bonds, real estate, international markets or currencies, emerging growth companies, or specific sectors.

Diversification is not a guarantee against loss.

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

© 2023. Nasdaq, Inc. All Rights Reserved.