Introduction to the Covered Call Strategy

Buy-write strategies have been utilized for over 20 years leveraging call options to generate income and hedge positions. Recently, their popularity has surged as they became available in ETF form, making them accessible to a wider range of investors. This blog will dive into the details of what a covered call strategy is, exploring how it works and why it’s gaining traction in the investment world.

The Basics of a Covered Call

In a covered call strategy, an investor who already owns shares in a company (let’s say 100 shares of company XYZ) decides to sell a call option on those shares. This means they’re giving someone else the right to buy their shares at a certain price (known as the strike price) within a specific timeframe. If the stock price doesn’t exceed the strike price before the option expires, the investor keeps the shares and the money paid for the option (the premium). If the stock price goes above the strike price and the option is exercised, the investor sells the shares at the strike price, potentially missing out on higher profits but still benefiting from the premium received and any gains up to the strike price.

Covered call writing can be expensive and resource-intensive, making it challenging for many investors to incorporate it into their portfolios. Fortunately, the introduction of covered call ETFs has made it easy for investors by handling the intricacies of running the strategy for them. The ETF’s management team handles the intricate steps of purchasing a basket of stocks, selecting an appropriate strike price and executing a call option on them.

Benefits of implementing a covered call strategy

Income and Yield Enhancement: A covered call strategy allows investors to generate income through premiums from selling call options, directly enhancing the yield of their investment portfolio. This dual benefit is especially valuable in low or volatile interest-rate environments or when market growth is modest, providing a steady income stream alongside any dividends or capital gains from stock holdings.

Potential Downside Protection: The premium received from the option sale offers a cushion against stock price declines. This partial protection can help mitigate losses during market downturns, making it a prudent choice for risk management.

Strategic Flexibility and Control: Covered call strategies afford investors greater control over their investment outcomes. By selecting the strike price and expiration date of the call options, investors can tailor the balance between risk and return according to their market outlook and investment goals. This flexibility allows for strategic adjustments in response to changing market conditions, potentially optimizing the portfolio’s performance over time.

Expected Performance in Various Markets

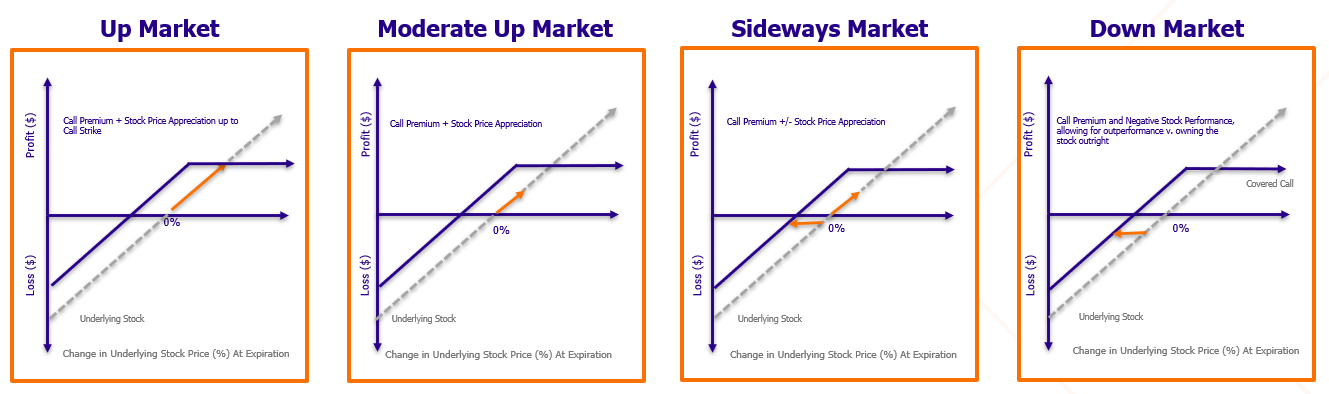

Putting these strategies into action, let’s also address how covered call strategies are expected to perform across various market conditions.

During robust market cycles, stock price appreciation is capped at the call strike level without further upside participation, although income is still generated.

Moderately Up Market: When equity markets are moderately up — an ideal scenario for covered call ETFs — the funds allow for premium income and continued exposure to stock price appreciation below the call strike level.

Sideways Market: During periods of oscillating prices, the underlying stock appreciation may be up or down. However, the covered call strategy still generates income.

Down Market: When markets are declining, the income generated from selling call options acts as a cushion, offsetting some — if not all — of the value lost by the depreciation of the underlying stock.

The versatility of covered call strategies across market conditions underscores their value in today’s volatile investment landscape. They offer a practical solution for income and risk management, making them increasingly popular among a broad investor base.

Conclusion

Covered call strategies simplify sophisticated strategies, allowing investors to manage risks and generate income more efficiently. The current market’s unpredictability makes them especially appealing, as they cater to the need for steady income sources and risk mitigation. REX Shares is ready to guide investors interested in exploring these strategies further.

Important Information:

Investing in the Fund involves a high degree of risk. As with any investment, there is a risk that you could lose all or a portion of your investment in the Fund.

Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information is in the prospectus. Please read the prospectuses carefully before you invest. Investments involve risk. Principal loss is possible. For FEPI prospectuses, click here.

THE FUND, TRUST, ADVISER, AND SUB-ADVISER ARE NOT AFFILIATED WITH THE FUND’S UNDERLYING SECURITIES.

Funds distributed by: Foreside Fund Services, LLC, not affiliated with Rex Shares, LLC, or its affiliates.

Options Contracts. The use of options contracts involves investment strategies and risks different from those associated with ordinary portfolio securities transactions. The prices of options are volatile and are influenced by, among other things, actual and anticipated changes in the value of the underlying instrument, including the anticipated volatility, which are affected by fiscal and monetary policies and by national and international political, changes in the actual or implied volatility of the underlying reference security, the time remaining until the expiration of the option contract and economic events. For the Fund in particular, the value of the options contracts in which it invests are substantially influenced by the value of the underlying securities.

Money Market Securities Risk. The Fund may invest in money market securities, which are short-term, highly rated fixed income securities. Although money market securities typically carry lower risk than equity securities, return of principal and interest may not be guaranteed.

Out of the Money Option: An out of the money call option has a strike price that is higher than the price of the underlying asset.:

Call Option: Call options are financial contracts that give the buyer the right—but not the obligation—to buy a stock, bond, commodity, or other asset or instrument at a specified price within a specific period.

Market Price: The current price at which shares are bought and sold. Market returns are based upon the last trade price.