Robinhood FY24 Q4 Earnings Tonight!

Key Insights

(Robinhood reports earnings 2/12/2025, after market close)

2024 Recap

In 2024, Robinhood stock returned over 200%, driven by significant product expansions. The company launched an advanced, browser-based trading platform, offering enhanced features at no cost. Additionally, Robinhood entered the betting space, allowing select users to participate in prediction markets, including election-related contracts. However, its recent plan to offer Super Bowl betting contracts was scrapped due to legal concerns. Investors should anticipate increased innovation from the company.

Investor Focus

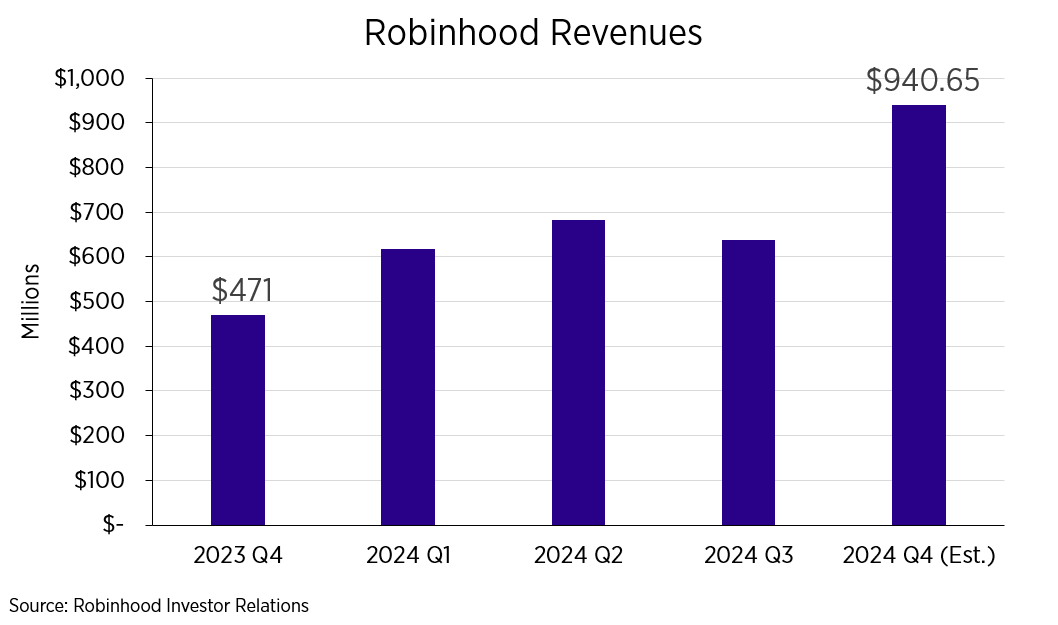

As a financial services company catering to all types of traders, Robinhood’s key performance metrics include Average Revenue Per User (ARPU), Gold Subscribers, Funded Customers, and Net Deposits. Investors should closely track these figures to gauge user engagement and platform growth. Additionally, revenue is projected to double year-over-year, with Q4 estimates reaching $940 million.

Q4 Earnings Estimates

Adjusted EPS: $0.42

2023 Q4 EPS: $0.03

Q4 Revenue Estimates

Revenue: $940.65M

2023 Q4 Revenue: $471.00M

Estimates Data Source: Zacks Investment Research

Trade Robinhood Earnings with T-REX!

The T-Rex 2X Long HOOD Daily Target ETF (the “Fund”) seeks daily leveraged investment results and is very different from most other exchange-traded funds. As a result, the Fund may be riskier than alternatives that do not use leverage because the Fund’s objective is to magnify (200%) the daily performance of the publicly-traded common stock of Robinhood Markets Inc. (NASDAQ: HOOD).

The Fund seeks daily investment results, before fees and expenses, of 200% of the daily performance of HOOD. The Fund does not seek to achieve its stated investment objective for a period of time different than a trading day.

Investing in the Funds is not equivalent to investing directly in HOOD.

A link to the HOOD fund prospectus can be found here. Click here for fund holdings.

The Fund is not suitable for all investors. The Fund is designed to be utilized only by knowledgeable investors who understand the potential consequences of seeking daily leveraged (2X) investment results, understand the risks associated with the use of leverage and are willing to monitor their portfolios frequently. The Fund is not intended to be used by, and is not appropriate for, investors who do not intend to actively monitor and manage their portfolios. For periods longer than a single day, the Fund will lose money if HOOD’s performance is flat, and it is possible that the Fund will lose money even if HOOD’s performance increases over a period longer than a single day. An investor could lose the full principal value of his/her investment within a single day if the price of HOOD falls by more than 50% in one trading day.

Important Information:

PERFORMANCE DISCLOSURE

Shares of the REX Shares ETFs are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally calculated) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense reimbursements or recoupments and fee waivers in effect during certain periods shown. Absent these reimbursements or recoupments and fee waivers, results would have been less favorable.

AFTER-TAX AND AFTER-TAX, POST SALES RETURNS

Tax-adjusted returns and tax cost ratio are estimates of the impact taxes have had on a fund. We assume the highest tax rate in calculating these figures. These returns follow the SEC guidelines for calculating returns before sale of shares. Tax-adjusted returns show a fund’s annualized after tax total return for the one, three and five year periods, excluding any capital-gains effects that would result from selling the fund at the end of the period. To determine this figure, all income and short-term capital gains distributions are taxed at the maximum federal rate at the time of distribution. Long-term capital gains are taxed at a 15% rate. The after tax portion is then assumed to be reinvested in the fund. State and local taxes are not included in our calculations. For more information, please consult your tax consultant.

INVESTMENT RISKS

An investment in the Fund entails risk. The Fund may not achieve its leveraged investment objective and there is a risk that you could lose all of your money invested in the Fund. The Fund is not a complete investment program. In addition, the Fund presents risks not traditionally associated with other mutual funds and ETFs. It is important that investors closely review all of the risks listed below and understand them before making an investment in the Fund.

Investing in a REX Shares ETF may be more volatile than investing in broadly diversified funds. The use of leverage by a Fund increases the risk to the Fund. The REX Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged, or daily inverse leveraged, investment results and intend to actively monitor and manage their investment.

Fixed Income Securities Risk. When the Fund invests in fixed income securities, the value of your investment in the Fund will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed income securities owned by the Fund.

Effects of Compounding and Market Volatility Risk. The Fund has a daily leveraged investment objective and the Fund’s performance for periods greater than a trading day will be the result of each day’s returns compounded over the period, which is very likely to differ from 200% of HOOD’s performance, before fees and expenses. Compounding affects all investments, but has a more significant impact on funds that are leveraged and that rebalance daily and becomes more pronounced as volatility and holding periods increase. The impact of compounding will impact each shareholder differently depending on the period of time an investment in the Fund is held and the volatility of HOOD during the shareholder’s holding period of an investment in the Fund.

Leverage Risk. The Fund obtains investment exposure in excess of its net assets by utilizing leverage and may lose more money in market conditions that are adverse to its investment objective than a fund that does not utilize leverage. An investment in the Fund is exposed to the risk that a decline in the daily performance of HOOD will be magnified. This means that an investment in the Fund will be reduced by an amount equal to 2% for every 1% daily decline in HOOD, not including the costs of financing leverage and other operating expenses, which would further reduce its value.

Derivatives Risk. Derivatives are financial instruments that derive value from the underlying reference asset or assets, such as stocks, bonds, or funds (including ETFs), interest rates or indexes. Investing in derivatives may be considered aggressive and may expose the Fund to greater risks, and may result in larger losses or small gains, than investing directly in the reference assets underlying those derivatives, which may prevent the Fund from achieving its investment objective.

Swap Agreements. Swap agreements are entered into primarily with major global financial institutions for a specified period which may range from one day to more than one year. In a standard swap transaction, two parties agree to exchange the return (or differentials in rates of return) earned or realized on particular predetermined reference or underlying securities or instruments. The gross return to be exchanged or swapped between the parties is calculated based on a notional amount or the return on or change in value of a particular dollar amount invested in a reference asset. Swap agreements are generally traded over-the-counter, and therefore, may not receive regulatory protection, which may expose investors to significant losses.

Indirect Investment Risk. Robinhood Markets Inc. is not affiliated with the Trust, the Adviser or any affiliates thereof and is not involved with this offering in any way, and has no obligation to consider the Fund in taking any corporate actions that might affect the value of the Fund. The Trust, the Fund and any affiliate are not responsible for the performance of Robinhood Markets Inc. and make no representation as to the performance of HOOD. Investing in the Fund is not equivalent to investing in HOOD. Fund shareholders will not have voting rights or rights to receive dividends or other distributions or any other rights with respect to HOOD.

Industry Concentration Risk. The Fund will be concentrated in the industry to which Robinhood Markets Inc. is assigned (i.e., hold more than 25% of its total assets in investments that provide inverse exposure to the industry to which Robinhood Markets Inc. is assigned). A portfolio concentrated in a particular industry may present more risks than a portfolio broadly diversified over several industries. As of the date of this prospectus, HOOD is assigned to the financials sector and capital markets industry.

Counterparty Risk. A counterparty may be unwilling or unable to make timely payments to meet its contractual obligations or may fail to return holdings that are subject to the agreement with the counterparty.

Rebalancing Risk. If for any reason the Fund is unable to rebalance all or a part of its portfolio, or if all or a portion of the portfolio is rebalanced incorrectly, the Fund’s investment exposure may not be consistent with its investment objective. In these instances, the Fund may have investment exposure to HOOD that is significantly greater or significantly less than its stated multiple. The Fund may be more exposed to leverage risk than if it had been properly rebalanced and may not achieve its investment objective, leading to significantly greater losses or reduced gains.

Daily Correlation Risk. There is no guarantee that the Fund will achieve a high degree of correlation to HOOD and therefore achieve its daily leveraged investment objective. The Fund’s exposure to HOOD is impacted by HOOD’s movement. Because of this, it is unlikely that the Fund will be perfectly exposed to HOOD at the end of each day. The possibility of the Fund being materially over- or under-exposed to HOOD increases on days when HOOD is volatile near the close of the trading day. Market disruptions, regulatory restrictions and high volatility will also adversely affect the Fund’s ability to adjust exposure to the required levels.

Liquidity Risk. Holdings of the Fund may be difficult to buy or sell or may be illiquid, particularly during times of market turmoil. Illiquid securities may be difficult to value, especially in changing or volatile markets. If the Fund is forced to buy or sell an illiquid security or derivative instrument at an unfavorable time or price, the Fund may be adversely impacted. Certain market conditions or restrictions may prevent the Fund from limiting losses, realizing gains or achieving a high correlation with HOOD. There is no assurance that a security or derivative instrument that is deemed liquid when purchased will continue to be liquid. Market illiquidity may cause losses for the Fund. To the extent that HOOD value increases or decreases significantly, the Fund may be one of many market participants that are attempting to transact in the HOOD.

Non-Diversification Risk. The Fund is classified as “non-diversified” under the Investment Company Act of 1940, as amended. This means it has the ability to invest a relatively high percentage of its assets in the securities of a small number of issuers or in financial instruments with a single counterparty or a few counterparties.

New Fund Risk. As of the date of this prospectus, the Fund has no operating history and currently has fewer assets than larger funds. Like other new funds, large inflows and outflows may impact the Fund’s market exposure for limited periods of time.

Financials Sector Risk. Performance of companies in the financials sector may be materially impacted by many factors, including but not limited to, government regulations, economic conditions, credit rating downgrades, changes in interest rates and decreased liquidity in credit markets. Profitability of these companies is largely dependent on the availability and cost of capital and can fluctuate significantly when interest rates change. Credit losses resulting from financial difficulties of borrowers also can negatively impact the sector. These companies are also subject to substantial government regulation and intervention, which may adversely impact the scope of their activities, the prices they can charge, the amount of capital they must maintain, and potentially, their size. Government regulation may change frequently and may have significant adverse consequences for financial companies, including effects that are not intended by such regulation. The impact of more stringent capital requirements, or recent or future regulation in various countries on any individual financial company or of the financials sector as a whole, cannot be predicted. The financials sector is also a target for cyber attacks and may experience technology malfunctions and disruptions, which have occurred more frequently in recent years.

Early Close/Trading Halt Risk. Although an underlying security’s shares are listed for trading on an exchange, there can be no assurance that an active trading market for such shares will be available at all times. An exchange or market may close or issue trading halts on specific securities or financial instruments, including the shares of the Fund. Under such circumstances, the ability to buy or sell certain portfolio securities or financial instruments may be restricted, which may result in the Fund being unable to buy or sell investments for its portfolio, may disrupt the Fund’s creation/redemption process and may temporarily prevent investors from buying and selling shares of the Fund. In addition, the Fund may be unable to accurately price its investments, may fail to achieve performance that is correlated with HOOD and may incur substantial losses. If there is a significant intra-day market event and/or HOOD experiences a significant price increase or decrease, the Fund may not meet its investment objective or rebalance its portfolio appropriately.

Sector Concentration Risk. The trading prices of the Fund’s underlying securities may be highly volatile and could continue to be subject to wide fluctuations in response to various factors. The stock market in general, and the market for technology companies in particular, where applicable, has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of those companies.

Fixed Income Securities Risk. When the Fund invests in fixed income securities, the value of your investment in the Fund will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed income securities owned by the Fund. In general, the market price of fixed income securities with longer maturities will increase or decrease more in response to changes in interest rates than shorter-term securities.

Underlying Security Investing Risk. Issuer-specific attributes may cause an investment held by the Fund to be more volatile than the market generally. The value of an individual security or particular type of security may be more volatile than the market as a whole and may perform differently from the value of the market as a whole.

Distributor: Foreside Fund Services, LLC, member FINRA, not affiliated with REX Shares or the Funds’ investment advisor.