The Rise of Covered Call ETFs

Amid the challenges in the fixed income markets, investors have increasingly sought alternatives for income. This quest has led many to explore the equity markets, particularly through strategies like Covered Call ETFs. These ETFs, which involve selling call options on equities, aim to provide a strategic balance of income generation, growth potential, and risk management, thus offering an innovative approach for those navigating the complexities of today's financial landscape.

The Great Income Migration:

While interest rates remain the highest they’ve been in years, the Federal Reserve is widely expected to begin cutting rates over the next 12 months. As yield-focused investors navigate this shift, they are increasingly drawn to covered call strategies like the REX FANG & Innovation Equity Premium Income ETF FEPI. Most covered call ETFs offer higher cash distributions than bond yields while maintaining some equity exposure, though with some upside restraints. This combination of steady income and growth potential addresses the challenge of outpacing inflation without excessive risk-taking.

Navigating Fixed Income Turbulence:

The fixed income market is currently facing significant challenges, marking a drastic shift from the prolonged bull market in bonds that investors enjoyed for 35 years. This era has come to a sudden halt, largely due to the Federal Reserve's aggressive interest rate hikes aimed at curbing inflation. The pace at which these rates have been increased is unprecedented, representing a stark departure from historical norms and signaling a new phase of uncertainty for fixed income investments.

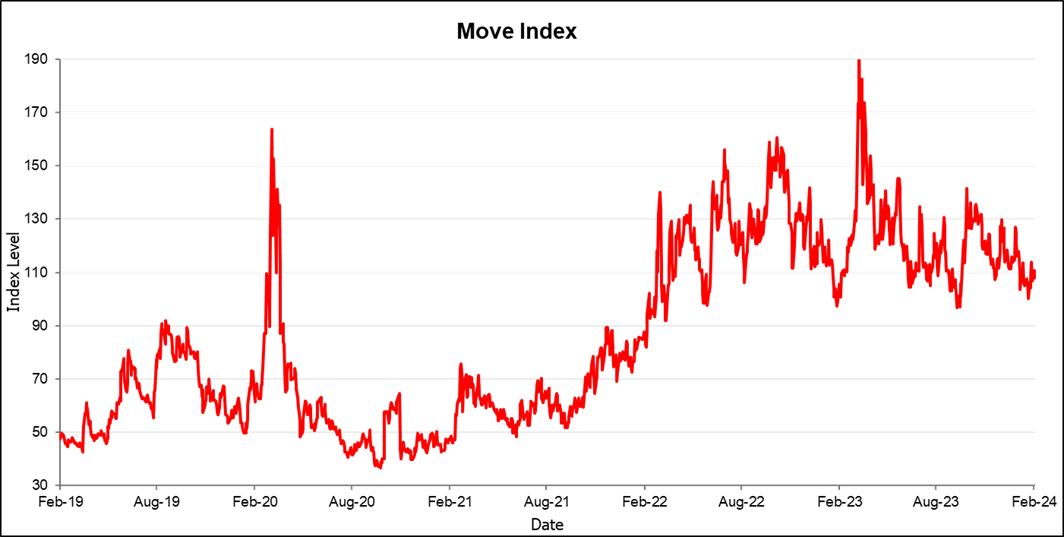

These rapid rate adjustments have inevitably led to heightened volatility in interest rates, a trend clearly reflected in the MOVE index, which has seen substantial spikes.

1Bloomberg L.P. as of 2/6/2024; The MOVE Index measures U.S. bond market volatility by tracking a basket of OTC options on U.S. interest rate swaps. The Index tracks implied normal yield volatility of a yield curve weighted basket of at-the-money one month options on the 2-year, 5-year, 10-year, and 30-year constant maturity interest rate swaps.

Such volatility is a direct consequence of the Fed's actions to manage inflation through monetary policy, illustrating the sensitive balance between economic control measures and their impact on financial markets.

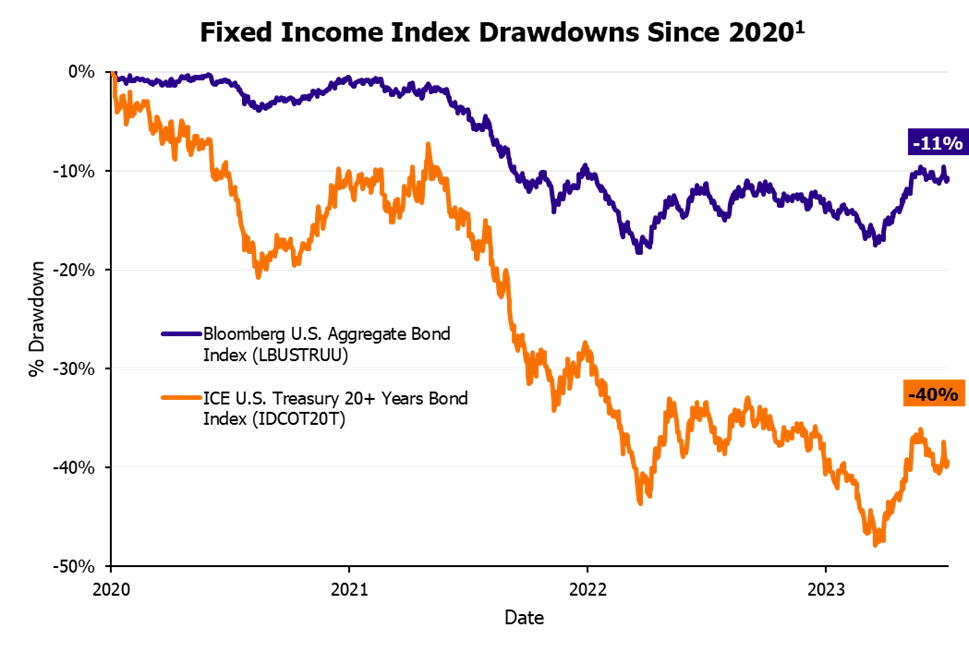

The repercussions for bond funds have been severe, with aggregate bond indices such as the Bloomberg U.S Aggregate Bond Index experiencing a downturn of over 10%. Long-dated Treasuries have fared even worse, seen by the ICE U.S Treasury 20+ Years Bond Index plummeting by 40%, which puts these declines on par with some of the most drastic equity market downturns observed.

1Bloomberg L.P. as of 2/7/2024; Returns calculated from 8/5/2020.

Bloomberg US Aggregate Bond Index (LBUSTRUU): The Bloomberg USAgg Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).

ICE U.S Treasury 20+ Years Bond Index (IDCOT20T): The ICE U.S. Treasury 20+ Years Bond Index is part of a series of indices intended to assess U.S. Treasury issued debt. Only U.S. dollar denominated, fixed rate securities with minimum term to maturity greater than twenty years are included.

Moreover, the yields from these bonds, already modest by historical standards, have turned effectively zero to negative once adjusted for inflation. This situation underscores the challenges investors face in the fixed income market, where traditional havens now seem fraught with unprecedented levels of risk and uncertainty.

A move towards Covered Call ETFs

Due to these challenges in the fixed income markets, many investors are increasingly turning to Covered Call ETFs as a strategic solution. These ETFs, through their approach of selling call options on portfolios, aim to provide income and might serve as a hedging measure during market downturns. Their growth, with a notable increase in assets and inflows, indicates an interest in options that strive for a balance between income potential and risk management, within the constraints of regulatory considerations for financial communications.

If you're considering adding covered call strategies to your portfolio, the REX FANG & Innovation Equity Premium Income ETF FEPI is quickly becoming a popular option for investors. FEPI distinguishes itself among covered call ETFs with its novel approach, merging income generation and growth prospects in stocks often overlooked by income-centric portfolios. Its tailored strategy of managing call options on each stock boosts potential yields, setting it apart from the usual index-centric buy-write methods. FEPI offers investors a strategic darkalignment with various investment objectives, making it an attractive choice for those exploring covered call strategies, thanks to its unique balance of income and growth potential.

Important Information:

Investing in the Fund involves a high degree of risk. As with any investment, there is a risk that you could lose all or a portion of your investment in the Fund.

Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information is in the prospectus. Please read the prospectuses carefully before you invest. Investments involve risk. Principal loss is possible. For FEPI prospectuses, click here.

THE FUND, TRUST, ADVISER, AND SUB-ADVISER ARE NOT AFFILIATED WITH THE FUND’S UNDERLYING SECURITIES.

Funds distributed by: Foreside Fund Services, LLC, not affiliated with Rex Shares, LLC, or its affiliates.

Options Contracts. The use of options contracts involves investment strategies and risks different from those associated with ordinary portfolio securities transactions. The prices of options are volatile and are influenced by, among other things, actual and anticipated changes in the value of the underlying instrument, including the anticipated volatility, which are affected by fiscal and monetary policies and by national and international political, changes in the actual or implied volatility of the underlying reference security, the time remaining until the expiration of the option contract and economic events. For the Fund in particular, the value of the options contracts in which it invests are substantially influenced by the value of the underlying securities.

Money Market Securities Risk. The Fund may invest in money market securities, which are short-term, highly rated fixed income securities. Although money market securities typically carry lower risk than equity securities, return of principal and interest may not be guaranteed.

Out of the Money Option: An out of the money call option has a strike price that is higher than the price of the underlying asset.:

Call Option: Call options are financial contracts that give the buyer the right—but not the obligation—to buy a stock, bond, commodity, or other asset or instrument at a specified price within a specific period.

Market Price: The current price at which shares are bought and sold. Market returns are based upon the last trade price.

NAV: The dollar value of a single share, based on the value of the underlying assets of the fund minus its liabilities, divided by the number of shares outstanding. Calculated at the end of each business day.

Liquidity Risk. Some securities held by the Fund, including options contracts, may be difficult to sell or be illiquid, particularly during times of market turmoil.

Derivatives Risk. Derivatives are financial instruments that derive value from the underlying reference asset or assets, such as stocks, bonds, or funds (including ETFs), interest rates or indexes. The Fund’s investments in derivatives may pose risks in addition to, and greater than, those associated with directly investing in securities or other ordinary investments, including risk related to the market, imperfect correlation with underlying investments or the Fund’s other portfolio holdings, higher price volatility, lack of availability, counterparty risk, liquidity, valuation and legal restrictions.

Call Writing Strategy Risk. The path dependency (i.e., the continued use) of the Fund’s call writing strategy will impact the extent that the Fund participates in the positive price returns of the underlying reference securities and, in turn, the Fund’s returns, both during the term of the sold call options and over longer time period.

New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have a track record or history on which to base their investment decisions.

Non-Diversification Risk. Because the Fund is non-diversified, it may invest a greater percentage of its assets in the securities of a single issuer or a smaller number of issuers than if it was a diversified fund.